Part II – This is the second part of a two-part blog series.

The Solutions: Improve the member experience with solutions that uniquely target each phase of the health plan member journey.

In Part I, we addressed three key challenges facing health plans today:

- Medication adherence

- Providing a positive and consistent customer experience

- CAHPS survey impact on Star ratings

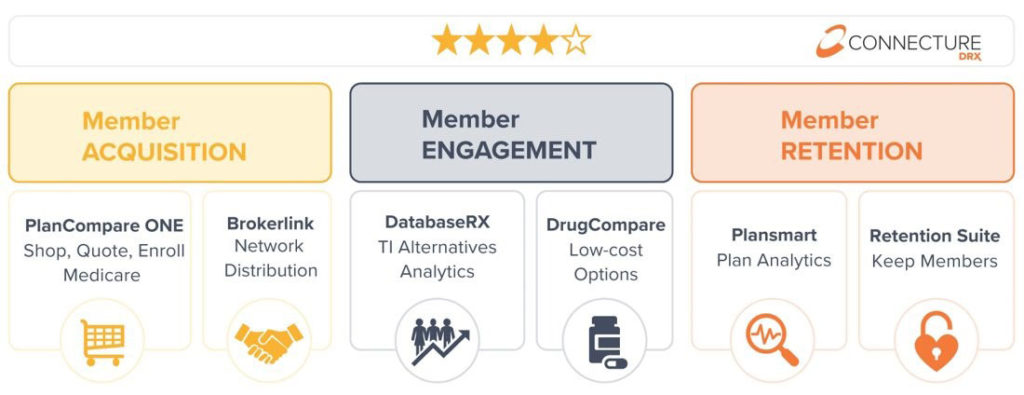

In Part II, we look at the solutions that impact each touch point in the member journey—from acquisition to engagement to retention necessary to delivering an optimal member experience.

ConnectureDRX Solutions that impact each part of the Member Journey

Member Journey Part 1: Acquisition

Our solution set begins with member acquisition. Having a multi-pronged approach to connect potential members with your plans is key, but it’s just as important to ensure those members are enrolling in the right plan from the start. The PlanCompareONE Medicare shopping and enrollment platform drives increased enrollments across all distribution channels with easy-to-use innovative tools for consumer self-service, call centers, ebrokers and field agents. Our extensive Brokerlink distribution network allows health plans to maximize plan exposure by connecting health plans to as many agents as possible, thereby driving higher health plan enrollment volume.

Member Journey Part 2: Engagement

Next, it’s important to go beyond “actions” to determine what constitutes “engagement”. To do so, we look at proactive member engagement strategies and tools like DatabaseRX therapeutic interchange database where Rx data allows health plans to direct members to lower-cost alternatives they can speak to their prescribers about. Lower-cost alternatives drive higher medication adherence which ultimately leads to improved health plan performance and elevated Star ratings.

DatabaseRX can be used in tandem with our DrugCompare drug transparency tool, allowing members to log on to a health plan web site and find lower-cost drugs themselves.

Member Journey Part 3: Retention

The ability to continually protect against disenrollment requires targeted member retention strategies. CAHPS surveys convey members’ “perceptions” about their experiences with their health plans, and proactively using the right data and messaging and employing the right technology puts health plans right where they need to be when surveys come out. Plansmart, the ConnectureDRX business intelligence tool uses predictive analytics to identify at-risk members so health plans can take action. When it comes time to CAHPS surveys, members will remember it was their health plan that addressed their concerns and saved them money.

Plansmart analytics and insights work in tandem with our Medicare Retention Suite technology to provide a more personalized enrollment experience by ensuring demographics and drug data information is available at agents’ fingertips. This data reduces call times when brokers and call center agents know what questions to ask members. Personalized messaging connects members to their health plans wherever they may be in their Medicare journey, whether that be aging into Medicare, transitioning from group insurance to Medicare, facing a plan discontinuation or other.

Please download our Health Plan Solutions whitepaper to learn more about how these solutions address health plan challenges at each phase of the member journey. Reach out to us with any questions at marketing@connecture.com.